NEW DELHI: The Centre is readying a programme to incentivise the local manufacture of key construction equipment to plug a yawning gap in India’s infrastructure development push that’s aimed at easing bottlenecks and boosting growth. Proposals for supporting the indigenisation of construction equipment, tunnel boring machines and cranes have been initiated, said officials aware of the matter.

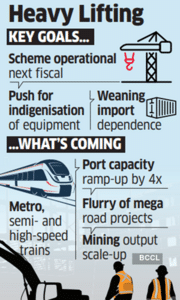

“Inter-ministerial consultations are underway on a Rs 14,000-16,000 crore incentive scheme for the construction equipment manufacturing industry,” a senior official told ET, adding that it’s likely to be operational in the next fiscal year.

According to sector watchers, India’s mining and construction equipment industry imports nearly half its components by value from China, Japan, South Korea and Germany, among others. “Consultations on the proposal have started,” the representative of a construction equipment manufacturer said.

The Indian construction equipment industry, inclusive of exports, grew 3% in FY25, said Manish Mathur, CEO, cranes, at equipment maker ACE. On the domestic front, the industry reported a 1% annual decline in sales during the first quarter of the current fiscal.

“A scheme to incentivise local manufacturing is much needed towards strengthening India’s construction and mining equipment ecosystem,” Mathur said. Much of the equipment needed for India’s ambitious infrastructure development programme comes from overseas.

Tackling Supply Chain Issues

“In India, the availability of large-scale construction equipment such as tunnel-boring machines (TBMs), cranes, and specialised rigs is still largely dependent on imports from global OEMs (original equipment manufacturers),” said Rahul Agarwal, chief financial officer, Patel Engineering Ltd. “This reliance can at times create tight supply conditions, especially when international demand is high or global supply chains face disruptions.”

He added that for time-sensitive infrastructure works, even short delays in securing equipment can influence execution timelines. To manage these pressures, engineering, procurement and construction (EPC) companies have focused on making better use of existing fleets through equipment rotation strategies, particularly at high altitude or remote sites. They are also entering into closer vendor partnerships to ensure timely delivery and incorporating escalation clauses as well as risk-sharing mechanisms into contracts to protect against price and supply fluctuations.

RAW MATERIALS

There is a significant level of variation in indigenisation levels across equipment categories. The industry is also dependent on imports for certain key raw materials such as specialty steels, an ICRA report said, adding that some types of hightonnage, fully built machinery are also imported.

The ratings agency estimated the Indian mining and construction industry’s localisation share could increase to 70-80% over the next five-seven years from less than half now. This has the potential of becoming a $25 billion market in annual revenue, translating into $3 billion in foreign exchange savings annually, it said. Imported components include hydraulics, undercarriages and high-tech components such as electronic control units (ECUs), sensors and telematics.

“The renewed push for large infrastructure projects like metros and bullet train corridors will significantly increase the demand for construction equipment such as tunnel boring machines,” said the official cited above. Mega port projects require large cranes, which are also currently being imported, he said.

BETTER PROJECT PLANNING

“A stronger domestic equipment base could reduce reliance on imports and make project planning more resilient against global price and supply fluctuations. Industry associations have previously suggested a dedicated Production-Linked Incentive ( PLI) scheme for heavy construction equipment, similar to those announced for sectors like electronics and automobiles, but this has not yet been extended to EPC machinery,” Patel Engineering’s Agarwal said.

Government procurement rules already give preference to Make in India products, yet challenges remain around the technical readiness of local suppliers for highly specialised equipment such as TBMs and cranes.

India plans to scale up its domestic port capacity by four times to 10,000 million tonnes per annum (mtpa) by 2047. The country plans a multi-fold increase in high-speed road corridors, touching 50,000 kilometres (km) by 2037 and scaling them to over 200,000 km by 2047. While one rapid rail corridor is nearing completion, plans to add more linking Delhi and the adjoining states are underway. New bullet train corridors are also anticipated with feasibility studies being conducted. There are also plans to increase the total length of metro corridors by around five times to 5,000 km by the 100th year of independence.

“Inter-ministerial consultations are underway on a Rs 14,000-16,000 crore incentive scheme for the construction equipment manufacturing industry,” a senior official told ET, adding that it’s likely to be operational in the next fiscal year.

According to sector watchers, India’s mining and construction equipment industry imports nearly half its components by value from China, Japan, South Korea and Germany, among others. “Consultations on the proposal have started,” the representative of a construction equipment manufacturer said.

The Indian construction equipment industry, inclusive of exports, grew 3% in FY25, said Manish Mathur, CEO, cranes, at equipment maker ACE. On the domestic front, the industry reported a 1% annual decline in sales during the first quarter of the current fiscal.

“A scheme to incentivise local manufacturing is much needed towards strengthening India’s construction and mining equipment ecosystem,” Mathur said. Much of the equipment needed for India’s ambitious infrastructure development programme comes from overseas.

Tackling Supply Chain Issues

“In India, the availability of large-scale construction equipment such as tunnel-boring machines (TBMs), cranes, and specialised rigs is still largely dependent on imports from global OEMs (original equipment manufacturers),” said Rahul Agarwal, chief financial officer, Patel Engineering Ltd. “This reliance can at times create tight supply conditions, especially when international demand is high or global supply chains face disruptions.”

He added that for time-sensitive infrastructure works, even short delays in securing equipment can influence execution timelines. To manage these pressures, engineering, procurement and construction (EPC) companies have focused on making better use of existing fleets through equipment rotation strategies, particularly at high altitude or remote sites. They are also entering into closer vendor partnerships to ensure timely delivery and incorporating escalation clauses as well as risk-sharing mechanisms into contracts to protect against price and supply fluctuations.

RAW MATERIALS

There is a significant level of variation in indigenisation levels across equipment categories. The industry is also dependent on imports for certain key raw materials such as specialty steels, an ICRA report said, adding that some types of hightonnage, fully built machinery are also imported.

The ratings agency estimated the Indian mining and construction industry’s localisation share could increase to 70-80% over the next five-seven years from less than half now. This has the potential of becoming a $25 billion market in annual revenue, translating into $3 billion in foreign exchange savings annually, it said. Imported components include hydraulics, undercarriages and high-tech components such as electronic control units (ECUs), sensors and telematics.

“The renewed push for large infrastructure projects like metros and bullet train corridors will significantly increase the demand for construction equipment such as tunnel boring machines,” said the official cited above. Mega port projects require large cranes, which are also currently being imported, he said.

BETTER PROJECT PLANNING

“A stronger domestic equipment base could reduce reliance on imports and make project planning more resilient against global price and supply fluctuations. Industry associations have previously suggested a dedicated Production-Linked Incentive ( PLI) scheme for heavy construction equipment, similar to those announced for sectors like electronics and automobiles, but this has not yet been extended to EPC machinery,” Patel Engineering’s Agarwal said.

Government procurement rules already give preference to Make in India products, yet challenges remain around the technical readiness of local suppliers for highly specialised equipment such as TBMs and cranes.

India plans to scale up its domestic port capacity by four times to 10,000 million tonnes per annum (mtpa) by 2047. The country plans a multi-fold increase in high-speed road corridors, touching 50,000 kilometres (km) by 2037 and scaling them to over 200,000 km by 2047. While one rapid rail corridor is nearing completion, plans to add more linking Delhi and the adjoining states are underway. New bullet train corridors are also anticipated with feasibility studies being conducted. There are also plans to increase the total length of metro corridors by around five times to 5,000 km by the 100th year of independence.

You may also like

Pakistan using jihadist proxies to suppress political dissent: Report

Anthony Joshua shows true colours with call-out to Tyson Fury

After Rs 5 crore aid by Tripura govt, BJP sends relief to flood-hit Himachal Pradesh

Chelsea given Liam Delap injury update as Enzo Maresca discovers new return date

How to watch Serbia vs England World Cup qualifier - TV channel, live stream, kick-off time