There’s a line between sound and poor investment advice and when fintech gurus or ‘finfluencers’ cross this line only to manipulate their followers, SEBI tends to crack the whip. That’s the hard truth learnt by subscription-based influencer and creator platform Rigi.

Founded by Ananya Singhal and Swapnil Saurav in 2021, Rigi has pulled the plug on its core finfluencer platform after such unregistered creators came under SEBI’s glare.

The public markets regulator has issued several notices since 2023 to unauthorised investment advisors or finfluencers associated with Rigi for giving advice to retail investors via private Telegram channels.

And just a few months after launching a dedicated app only for SEBI-registered advisors, the company has pulled the plug and is now focussed on the beauty and personal care creator ecosystem instead.

In many ways, this seems like Rigi’s last roll of the dice, which suffered a significant slowdown and had to cut back on several fronts after SEBI’s actions and penalties.

Having last raised funds more than two years ago, Rigi needs the beauty bet to work, but it’s not going to be an easy way out after the rollercoaster of the past two years.

Rigi Cashes In On The Trading BoomHundreds of social media channels and chat groups emerged during and after the pandemic, as retail investors sought to capitalise on the booming stock markets following the zero interest rate policy (ZIRP) adopted by most central banks. In just five years (FY20 to FY24), the number of demat accounts in India has skyrocketed from 4 Cr to a staggering 15 Cr.

Singhal and Saurav — both BITS Pilani graduates — started in 2021 to create an ecosystem that could support and enable the creator ecosystem emerging in areas such as investment advice, fantasy sports, and lifestyle content.

Rigi’s strategy was not limited to investment and finance advice – it roped in creators from diverse areas like fitness, beauty, sports and gaming, nutrition, and travel. But personal finance and trading became a huge monetisation play and it focussed its energies on creators in this space.

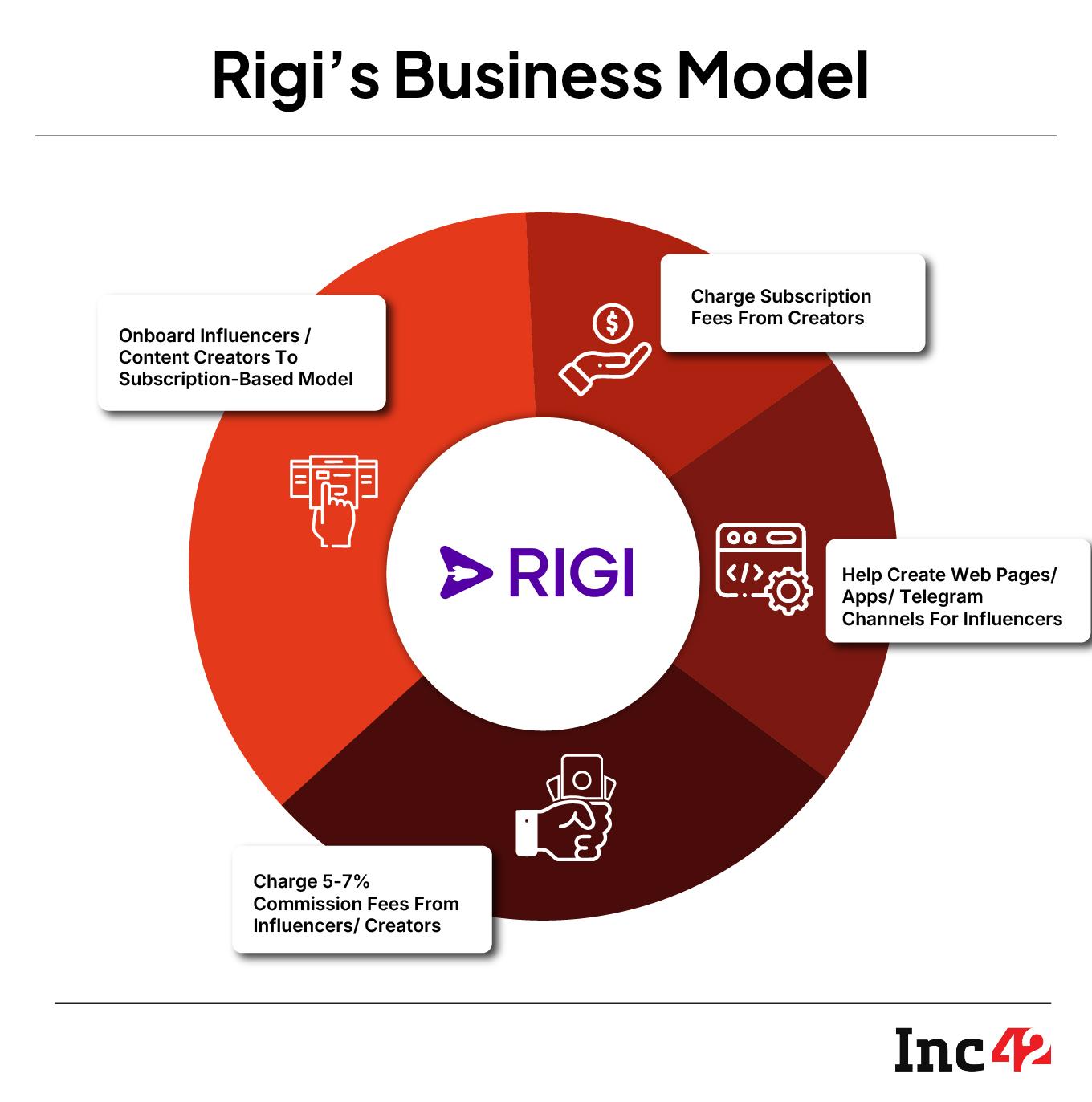

Rigi leveraged the stock market boom to help influencers in this domain reach a larger audience through educational courses created on its website and app. The business model involved launching paid Telegram channels for finfluencers, managing their payments, and providing tech support for their third-party apps and social media channels.

It also hosted content in the form of courses, webinars and videos under a subscription plan starting from INR 499. In terms of the commission, Rigi typically charged 5%-7% on the cumulative earnings made by the creators or influencers.

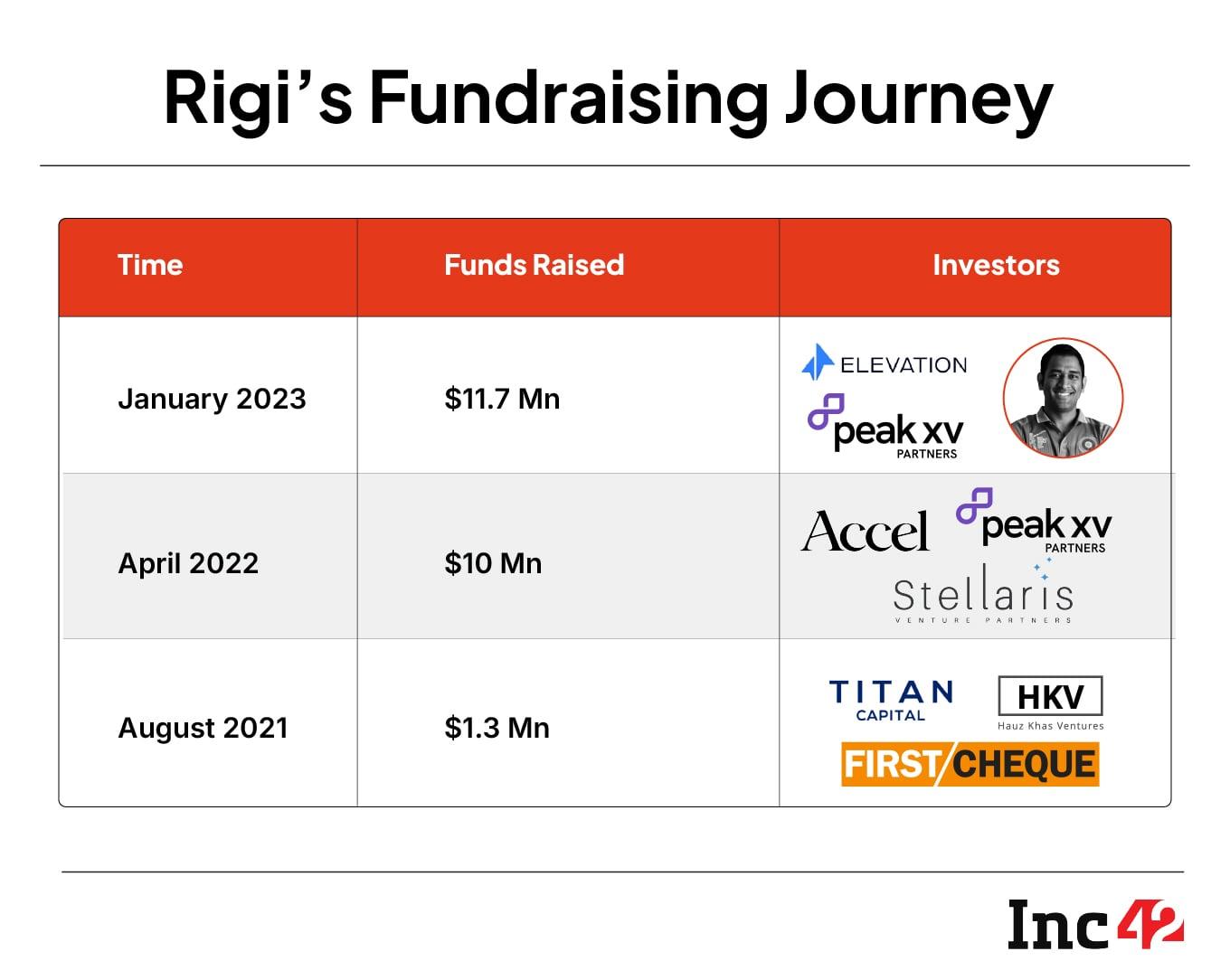

The idea took off and Rigi attracted investors like Accel, Elevation Capital, Peak XV Partners, CRED’s Kunal Shah, NoBroker’s Amit Kumar Agarwal, Country Delight’s Chakradhar Gade, social media influencer Sharan Hegde, and former Indian captain MS Dhoni.

The startup has raised $25 Mn till date, and last raised led by Elevation Capital.

The Rigi website claims to have more than 10 Lakh content creators so far. A bulk of these came in the early days of the company. Between 2021 and 2023, influencers and content creators sought to ride the stock market wave and capitalise on the trading boom.

According to SEBI data, India has close to catering to 100 Mn+ investors, as of August 2024. But during the market rally, hundreds unregistered finfluencers set up shop to grab the limelight as well, and it’s hard to track the number of such creators in the market today.

Then Came The SEBI StormBut where there’s a boom, there are also scams. A number of Telegram channels came up during that time which seemed to be misleading investors. Many were alleged to have given some very dodgy advice, leading to the SEBI crackdown in 2023. In particular, SEBI fined individuals who were providing advice without the requisite registrations and approvals.

Inc42 waded when a number of these creators were alleged to have manipulated investors to invest in stock that benefitted them directly. Action against creators such as PR Sundar, Ravisutanjani Kumar, Abhishek Kar and others brought more attention to the problem of unsound financial advice.

The SEBI crackdown not only tackled influencers but also platforms such as Rigi that seemingly were growing on the back of unauthorised financial advice. And the impact on Rigi was clear from the company’s reaction in the immediate aftermath of the crackdown.

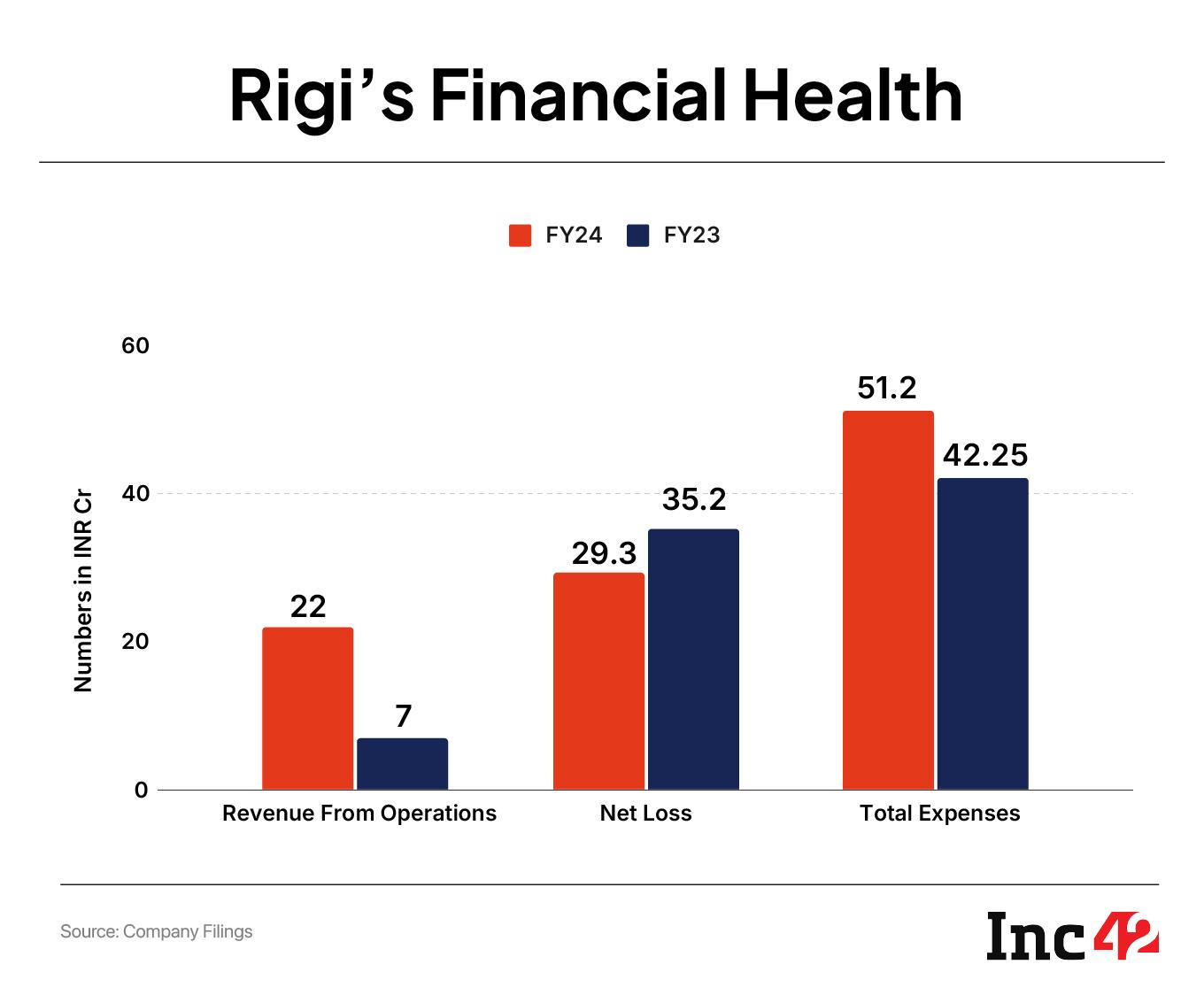

Rigi’s idea was showing traction, and its revenue had grown to INR 22 Cr in FY24 from INR 7 Cr in FY23, and losses had shrunk to INR 29.34 Cr from INR 35.18 Cr. But sources we spoke to say the growth could have been much higher had it not been for the SEBI intervention.

But after SEBI cracked the whip in March 2023, the company ran into a rough patch, and laid off 60% of its workforce across tech, content, marketing and operations teams, sources told Inc42.

One former senior employee who was let go said that today the company is still hiring for some positions, though the remunerations being offered are below industry standards. “A majority of the employees who were laid off were from senior-level positions and drew high salaries,” the source added.

Another former employee said that the company turned to other products like training influencers to build their presence and reach on Instagram, travel, astrology, beauty content after 2023 to diversify revenue and lower its dependence on the finfluencer-led business.

Queries sent to Rigi over the developments remained unanswered till the time of filing this story. We will update the story as and when the company responds.

Of Rogue Finfluencers, And Brand DhoniOver the past few years, SEBI has brought down at least 70,000 unregistered digital financial advisors offering investment advice without approval, SEBI chairperson Tuhin Kanta Pandey said in his first board meeting in March.

The market in January of this year. And this has further cleaned up the space and given more prominence to registered advisors.

Rigi also changed things around. While the startup still offers creator-run courses on personal finance and investments, it does this through a separate app called Gap Up. The app claims to have onboarded SEBI-registered experts for providing daily stock tips to investors.

Gap Up was launched in October 2023, just a few months after Rigi made . But the pressure from SEBI did not ease up.

As the regulatory noose tightened around unregistered finfluencers, Rigi pulled down Gap Up from Google Play Store and Apple App Store in March this year.

“While most of these real-time trading sessions are for investment education purposes, the followers of influencers end up copying the trade bets and their investment decisions,” a veteran market trader told us, requesting anonymity.

It also distanced itself from influencers hit by SEBI penalties, stating that content being hosted on private Telegram channels was not the property of Rigi and that it only acts as a tech platform for creators to help monetise their content.

But fresh debates erupted when Rigi’s brand ambassador and investor Dhoni’s image and name was used by unregistered finfluencers in December 2023. Some finfluencers also used selfies they had purportedly taken with Dhoni at Rigi’s annual event, just to promote their investment advice courses.

These influencers were running the social media handle Investographer1 with their app being reportedly run by Rigi’s tech stack. The company once again tried to distance itself from the controversy by stating that it did not endorse the financial advice given by these finfluencers.

According to sources, investment influencers charge subscription fees in the range of INR 12,000 to INR 20,000 quarterly for access to their Telegram channels or private chatrooms.

“Some of them are now running private clubs with disclaimers that the influencers are not SEBI-registered, however, the larger question is if platforms like Rigi are not onboarding unregistered influencers, they should not be selling their products or solutions as well,” a Bengaluru-based wealthtech startup founder pointed out.

While Rigi claimed to have issued guidelines on onboarding only those financial influencers who are registered with the regulator, even a cursory look at the Rigi app shows that several influencers who had admitted to violating the SEBI guidelines are still on the platform.

Insiders said that the decision to shut Gap Up was prompted by SEBI’s increasing crackdown on unregistered influencers and notices issued to Rigi. Rigi declined to respond to our queries about the fate of this app.

“After the SEBI crackdown, it became a challenge for Rigi to maintain its cash flow when many influencers had to be delisted from the platform. The platform does not call itself a fintech app, but a technology service enabler. However, there is a grey area whether it comes under the SEBI purview. Consequently, this led to various cost-cutting measures within the company,” a former senior employee from Rigi’s operations team told Inc42.

The Beauty App: One Last Roll Of The Dice?Stock markets were the big game in town in 2021, but Rigi diversified as soon as it had to.

Last year, it attempted an edtech-like offering courses to social media influencers on content strategy and online presence. But this was brought down because it did not work, sources said.

The startup launched Lit Vibes, a short video and content app focussed on the beauty and personal care and lifestyle industry. Released as an Android app in March 2025, Lit Vibes offers pay-to-view content starting at INR 49. The company is roping in influencers from beauty and travel space to create a platform that could also potentially cater to brands in the future.

In its first month, the app has clocked more than 10,000 downloads with 568 reviews and a rating of 4.9 on Google Play Store.

But Indian short video apps are more or less dead and competing with the likes of Instagram and YouTube will not come cheap. As we reported in the past when we examined the situation and , a majority of homegrown apps are unable to compete with international giants when it comes to ad revenue share or user sign-ups.

“Subscription business aimed at Tier II and Tier III towns and beyond continues to pose a challenge to startups since the pay-to-view business model has not shown much success in India so far,” the founder of a Bengaluru-based influencer management agency told Inc42.

Even OTT channels and platforms have slashed monthly subscription fees to target a wider audience. “While roping in small influencers should not be an issue for a startup like Rigi, the challenge will be to retain them by giving them monthly payouts or having enough users who will subscribe to it,” the founder added.

But there’s also a feeling that this is the last roll of the dice for Rigi. Creator-focussed SaaS platforms and enablers like Rigi have failed to live up to the hype and prominence of 2020 and 2021.

Their income is directly linked to how much they can bring in for creators, and without a virtuous loop of creators and users, the likes of Rigi need to constantly move to the next new trending area to survive. Especially when creators have native tools by YouTube or Instagram at their disposal in many cases.

It would be unfair to dismiss Lit Vibes and Rigi’s latest effort just yet, but at the same time, we have to acknowledge that building in beauty and personal care is a completely different ball game than catering to regulated financial advice.

It’s been two years since the startup last raised funds, and even if it has cut costs across the board, the bet on beauty looks like the last roll of the dice for Rigi.

The post appeared first on .

You may also like

Committed to building inclusive, progressive and developed Maharashtra: Governor

Unique new Android phone arrives in UK this month and it's Nothing like its rivals

IPL 2025: Shreyas Iyer Is Really Hungry For Success, Says Ponting After Win Over CSK

F1 LIVE: Lewis Hamilton 'can't cope' at Ferrari as Sergio Perez backed for shock return

CNN abruptly pulls broadcast as Donald Trump breaking news announced