After the RBI’s whip on its payments bank arm last year, the worst seems to be behind Paytm. Far from declining revenues and bleeding losses that headlined most of the fintech giant’s FY25, the ongoing fiscal year brought happy tidings for the company.

After clocking its first operationally profitable quarter in Q1 FY26, the company managed to stay in the black in the quarter ended September 2025. But profits declined 98% year-on-year (YoY) and 83% sequentially to INR 21 Cr.

The steep decline had largely to do with the INR 2,048 CrPaytm Insider sale in Q2 FY25 and not any operational reason. That said, the fintech major would have maintained the momentum in the recently concluded quarter, too, if the real money gaming (RMG) sector hadn’t undergone an expected regulatory gridlock in August.

In addition,the company’s Q2 financials were dented by an INR 190 Cr loan it had to write off to its real money gaming (RMG) joint ventureFirst Games. If not for this expense, Paytm’s bottom line would have been in a much better shape, soaring about 80% from the last quarter to INR 221 Cr.

Nevertheless, it must be noted that the company’s top line has maintained consistent growth over the past few quarters. Operating revenue in Q2 surged 24% YoY and 7% QoQ to INR 2,061 Cr.

With its profitability puzzle solved, the fintech major is now setting sail for its new era – rather than chasing profits, it now plans to focus energies on strengthening its top line. This is precisely what Paytm’s CEO and founder Vijay Shekhar Sharma said during its Q2 earnings call.

What else? With two consecutive profitable quarters, the company is now pivoting from cost control to growth — anchored by merchant expansion, credit innovation, and AI monetisation.

Here are the key highlights of what Paytm plans to achieve going forward:

Paytm Postpaid RevivalA year after shutting down its buy-now-pay-later (BNPL) product, Paytm revived its credit on UPI service, Paytm Postpaid, in September as a credit line on UPI.

While the service is restricted to select users for now, Paytm aims to expand it in the coming months.

The company’s plans for Postpaid 2.0 were at the front and centre of its Q2 earnings call. It had shut down this service in May 2024 amid an industry-wide decline in asset quality.

With the UPI integration, the company noted that enabling Paytm Postpaid through UPI rather than credit cards gives it wider acceptance and makes it easier to use across more merchants.

Sharma said that Paytm Postpaid will effectively be focussed on small-ticket loans, offering users up to 30 days of short-term credit. With this, Paytm is re-envisioning Paytm Postpaid as a fee-based product instead of a traditional EMI-based loan arrangement.

“It does have a credit cost involved, but it is not an EMI product. Hence, it does not compete with the equivalent of EMI for iPhone; it rather is a consumption credit. We offer credit to people who need up to INR 50K-60L in a month to match the expenditure and they are expected to pay it back at the end of the month,” he noted.

Talking about the fee on the product, Sharma said that users with high credit scores might get a short-term credit at 0% charge, while others might end up paying a 1-2% charge.

It must be noted that the relaunch of Postpaid is part of Paytm’s broader plan to leverage its user base in the digital payments ecosystem.

Despite having the early mover advantage in the segment, Paytm has been a distant third contender in the UPI ecosystem. However, overtaking its rivals PhonePe and Google in terms of user base doesn’t seem to be on Paytm’s agenda as of now.

“We are clear about it that we don’t have a large MTU (monthly transaction users). Over the period, the customers who stayed with us, are higher quality customers. To enhance this number, AI, wealth and private disbursement products will be added to our portfolio,” Sharma added.

While Paytm Postpaid is still in its infancy, the BNPL product is expected to cushion its larger financial services distribution vertical.

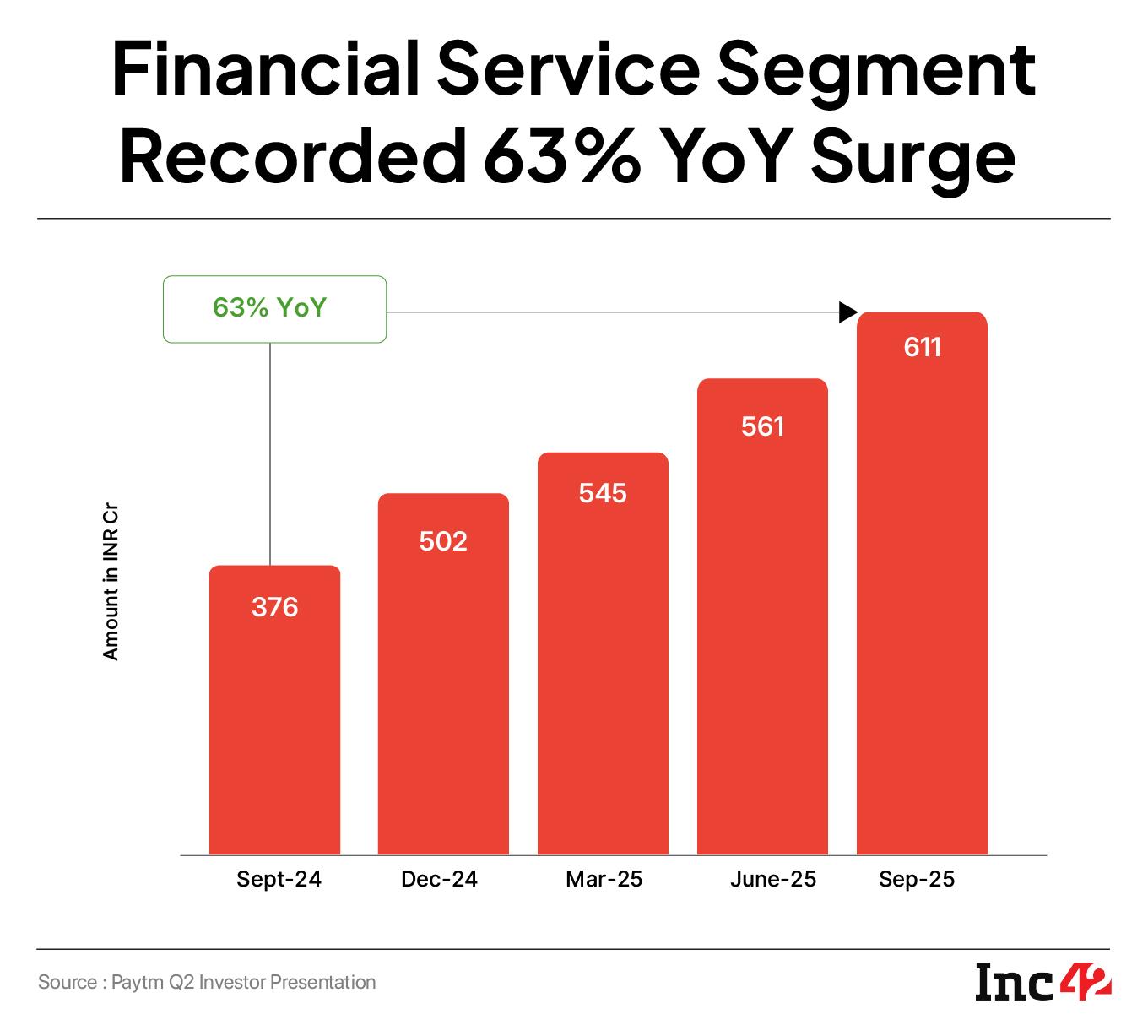

Overall, this segment saw a 63% jump in its revenue to INR 611 Cr in the quarter under review, from INR 376 Cr in the same quarter last year. While Paytm did not disclose the exact segregation of loan disbursement, Sharma added that merchant loans continue to grow on both volume as well as revenue terms.

Doubling Down On Payments ServicesAfter stabilising its financial footing, Paytm is now also sharpening its focus on its core payments business — the engine that powers most of its ecosystem. Just days ago, the company announced an INR 2,250 Cr investment in its payments arm, Paytm Payment Services Limited (PPSL), through a rights issue — a move long in the making since receiving regulatory clearance in August 2024.

The fresh capital will strengthen PPSL’s net worth, fund the acquisition of its offline merchant payment businesses, and support working capital requirements as Paytm seeks to consolidate its merchant payments leadership.

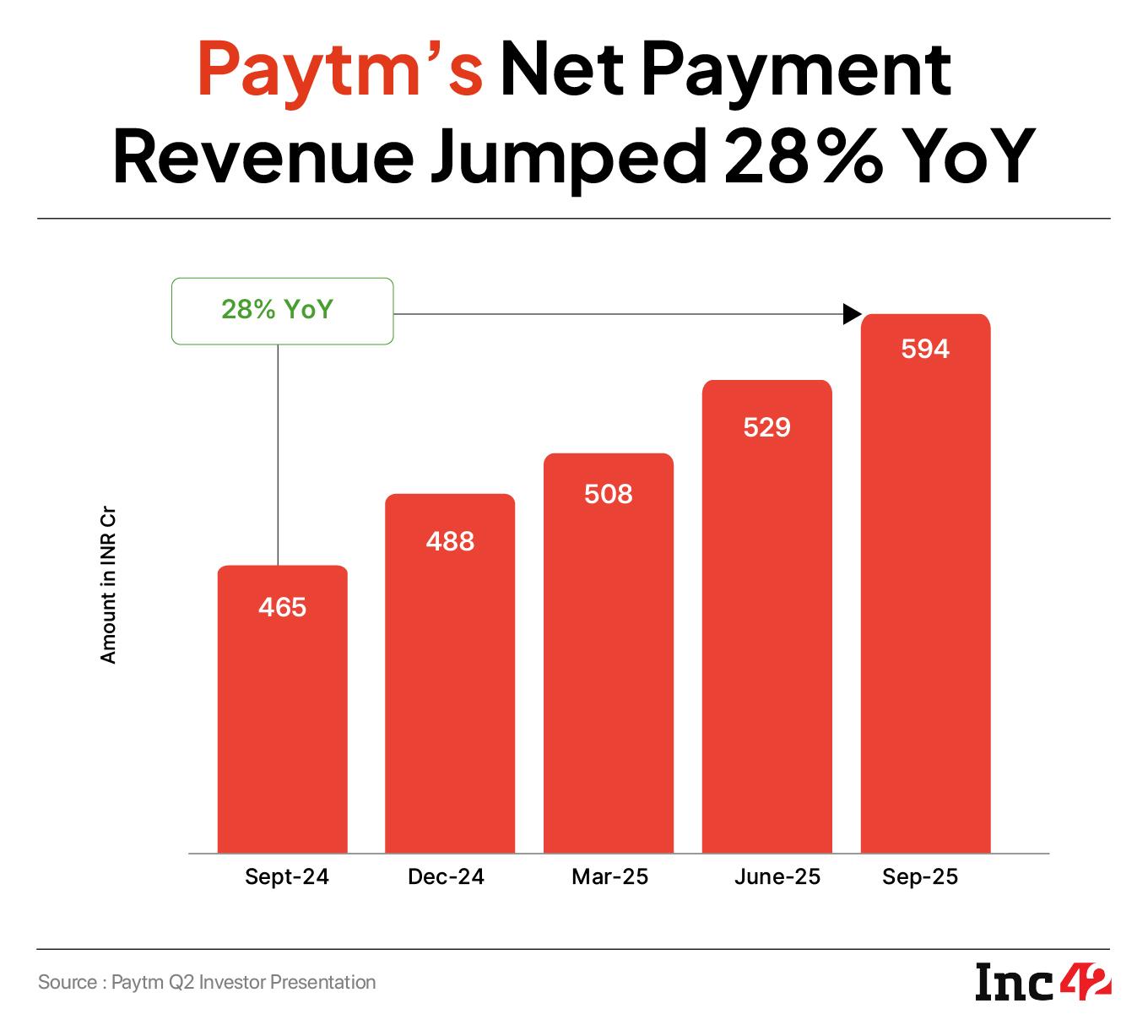

In Q2, the segment posted solid growth, with payment processing margin revenue rising 27% YoY to INR 594 Cr and subscription volumes increasing to 1.37 Cr from 1.12 Cr a year ago. Both revenue streams stem from merchants – Paytm’s core – who pay for using its devices and digital payment infrastructure.

Now, with profitability restored, Paytm plans to accelerate merchant acquisition, particularly among offline and small businesses. The new infusion into PPSL will fund on-ground sales expansion and credit products for merchants, including EMI offerings, which are gaining traction.

“We want to dominate in the merchant ecosystem and acquire a large amount of enterprise onboarding, with aggressive focus on acquiring small offline merchants,” CFO Madhur Deora said.

Besides, Paytm’s global ambitions for its consumer-facing business are also taking shape. The company is taking a selective approach to international markets, particularly in Southeast Asia, operating directly in some countries and via partnerships in others.

The recentfeature allowing NRIs in 12 countries, including the US, the UK, and the UAE, to make UPI payments via international mobile numbers, marks the first step toward that global expansion.

Paytm’s AI Play Takes ShapeParallel to its payments expansion, Paytm continued to build what it positions to be its new growth lever – AI. The company’s automation push helped trim employee expenses by 32% YoY in Q1 FY26, and by 20% YoY in Q2 to INR 663 Cr.

But the company’s ambition goes beyond operational savings. Sharma now envisions AI as a revenue driver, leveraging Paytm’s vast merchant base to cross-sell AI-powered infrastructure and products — including digital assistants, predictive analytics, and smart payment devices to improve merchant productivity.

Paytm is currently testing these tools internally before launching them commercially. The goal is to expand into AI-led ecommerce and cloud services by FY27, effectively making AI as a backend tool for a customer-facing business vertical.

With another profitable quarter in the books, all eyes would be on the Delhi NCR-based company’s execution in making these plans a reality. A key question still hangs in the balance – will the company’s three key levers payout, as promised, moving forward?

[Edited by Akshit Pushkarna]

The post Paytm’s Next Big Bets — Postpaid 2.0, Payments & AI appeared first on Inc42 Media.

You may also like

Alex Oxlade-Chamberlain shows where his loyalties lie with Arsenal and Liverpool comment

Furious Question Time clash erupts as Fiona Bruce shut down over Rachel Reeves blunder

Celebrity Race Across the World star's dad makes emotional admission

Bihar polls: 57.9% turnout in Patna district as young & old come out to vote

King Charles sends 'blunt message' to Princesses Beatrice and Eugenie amid Andrew scandal